Transaction Advisory Services

What lies behind the acquisition of a group, company or property?

What are the value drivers and opportunities to be exploited? What are the risks and obstacles?

What strategies for integration and economic value creation post-acquisition?

A successful acquisition/disposal involves hard work and dealing with a multitude of challenges, difficulties and unforeseen events throughout the process. Each decision to be made by each contractor can be complex, burdensome and prejudicial if it is not supported and justified by a thorough analysis and verification process and a solid set of facts & figures.

HELVIA’s buy-side transaction advisory services are aimed at potential Buyers or Investors of shareholdings, companies and properties, who wish to secure their investment by ascertaining its strategic, organisational and cultural coherence and the real capacity for the creation of economic value and return on investment.

HELVIA’s Sell-side transaction advisory services are aimed at potential Sellers or Prospectors of Partners (strategic or financial) who wish to facilitate the process of information delivery, negotiation negotiations and ascertain the real strategic, contractual and economic-financial convenience of the possible sale or shareholder entry transaction.

HELVIA’s independent transaction advisory services are aimed at both parties (Buy-side and Sell-side) and are provided by HELVIA as an independent professional and in conditions of total absence of conflict of interest, undue influence or bias. Their purpose is to facilitate the settlement of an agreement or to resolve a pending dispute between the parties, providing them with an opinion or report inspired by the principles of competence, diligence, objectivity and professional integrity.

HELVIA’s professionals critically analyse and evaluate the state of the art and growth prospects of the business, the potential synergies obtainable from an aggregation, the chances of creating economic value and financial returns, the risks latent in the balance sheet and business plan, the congruity of prices and contractual conditions, etc., favouring the considered decision-making of the Principals, to ensure their peace of mind and the success of the operation.

HELVIA’s expertise allows for a one-stop-shop of a wide range of professional services inspired by international best practices and indispensable guidance and support to avoid bad surprises and ensure the consistency, sustainability and cost-effectiveness of extraordinary transactions.

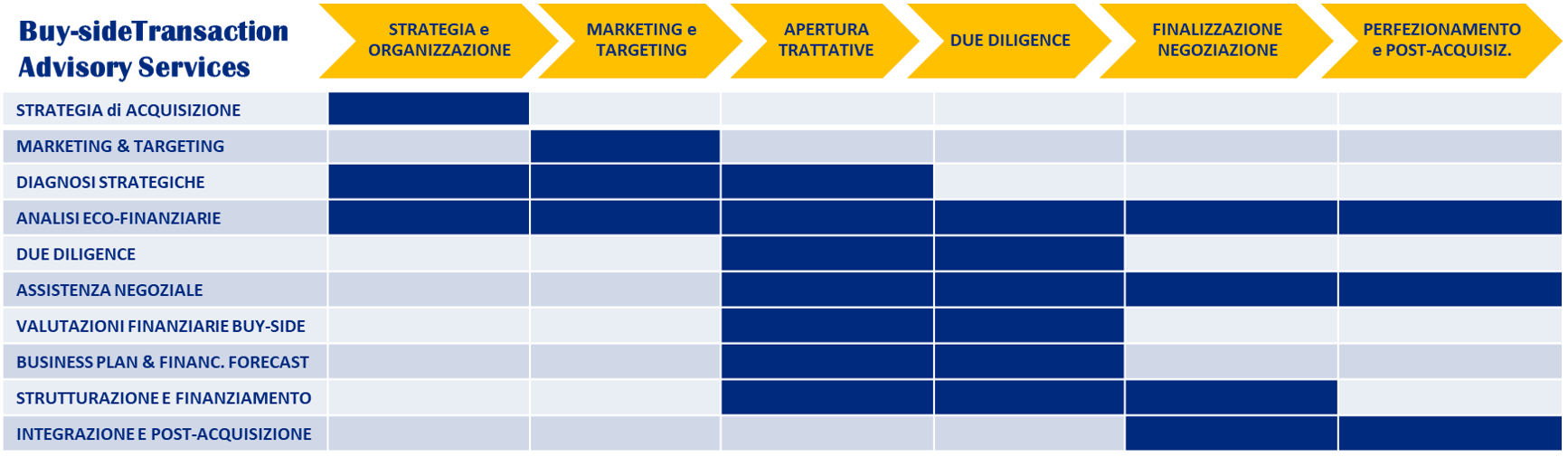

HELVIA Buy-side Transaction Advisory Services (1-2)

Acquisition Strategies

The success of an acquisition rests on a well conceived and executed strategy. This requires clarity and consistency in the strategic objectives, effectiveness in identifying and achieving targets, correct forecasting and allocation of resources to finalise the deal. HELVIA supports you with expertise in the formulation of your external growth strategy.

Market Intelligence & Targeting Campaigns

An M&A service is worthless if it cannot approach target decision-makers. HELVIA has an efficient Market Intelligence & Targeting Campaigns service that confidentially selects and contacts local, national and global targets (on 5 continents). HELVIA also has an extensive selected portfolio of companies and properties for sale.

Strategic Diagnosis and Feasibility Studies

To support the client, HELVIA carries out strategic diagnoses, sector analyses, competition analyses, market surveys, benchmarking studies, formulation of corporate or business strategies, internationalisations, downsizing/rightsizing feasibility or new business projects.

Economic and Financial Analysis

Analyses measure past performance and guide future performance. HELVIA performs balance sheet analyses, analysis of potential synergies, analysis of financial requirements or investments, treasury planning, cashflow optimisation, research of drivers for economic value creation.

Due Diligence

HELVIA performs preliminary due diligence (pre-due diligence or desktop due diligence), i.e. initial examinations of data and information of the target company or property, to ascertain whether or not it is a good business for the Principal, from a strategic, financial and cultural (fit) point of view, before engaging him in a full and costly due diligence process. Full financial and business due diligence is performed by HELVIA, at its discretion.

HELVIA Buy-side Transaction Advisory Services (2-2)

Negotiation Assistance

Negotiation skills derive from both the technical and professional understanding of the transaction and the culture, expectations and way of thinking and acting of the counterparty. Since 1984, HELVIA professionals have been able to guide and support you in target selection, opening of negotiations, drafting of LoI/MoU or drafting of purchase offers (NBO or BO), negotiation and finalisation of agreements.

Buy-side Financial Valuations

HELVIA supports potential Buyers with company valuation services and acquisition price negotiation strategies. For more information, please see: ‘Company Valuation Services’.

Business Plan and Financial Forecast

Forecasting the objectives and strategic implications of the acquisition or merger project, the operating conditions of the business, the measures for growth or rationalisation or turnaround or release of synergy potential, the potential risks, and the economic-financial impacts is a categorical imperative. HELVIA offers this service to Principals in order to ensure the convenience and sustainability of the investment.

Structuring and Financing the Transaction

HELVIA assists the Principal in mitigating and balancing the investment risks, using instruments such as earn-outs, ratchets, milestones, notes, stocks, escrows, balloon loans, perpetuities, etc., and in choosing and using leverage (LBO, LMBO, LMBI, OBO, BIMBO, etc.) and financing instruments and sources.

Post-Acquisition Integration and Execution Plans

Planning and monitoring the integration and post-acquisition management process of the target company through a multi-project WBS and roadmap ensures the alignment of the target with the strategic and economic-financial objectives, procedures and values of the acquiring entity.

Chronoprogramme of Transaction Advisory Buy-side Services

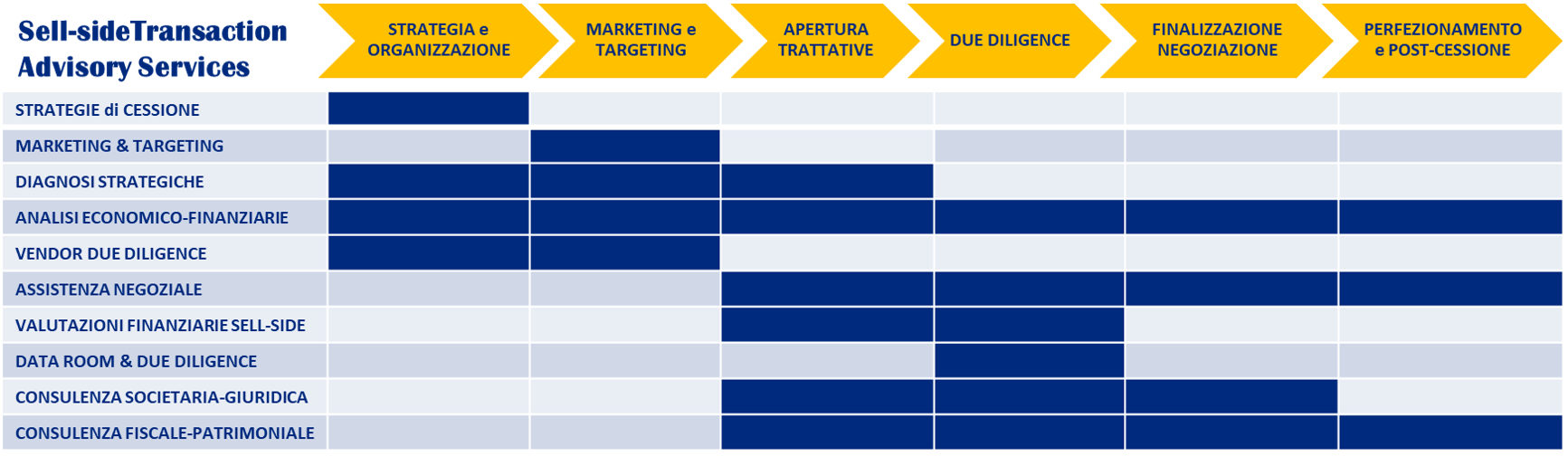

HELVIA Sell-side Transaction Advisory Services (1-2)

Divestiture Strategies

The sale of a shareholding, company or property is a delicate step that requires the utmost attention and experience. Since 1984, HELVIA has been at the side of owners, entrepreneurs and administrators to help them formulate and implement the best divestment strategy, to organise the target for sale and the communication pitch book (InfoMemo, Teaser, etc.).

Market Intelligence & Targeting Campaigns

HELVIA has an efficient Market Intelligence & Targeting Campaigns service that selects and confidentially contacts potential Buyers of the object for sale, locally, nationally and globally (on 5 continents). The company or property for sale is also presented to the extended portfolio of Buyers and Investors of HELVIA’s ProINVESTO Deal Club.

Strategic Diagnosis and Feasibility Studies

In order to facilitate the preparation of the pitch book and the negotiation between the parties, HELVIA carries out strategic diagnoses, sets up corporate or business unit or global strategies, analyses and surveys of demand and market potentials, benchmarking, feasibility studies, analyses of potential synergies of aggregation, economic and financial analyses of various kinds.

Economic and Financial Analysis

Applying the techniques of financial analysis and value-based management, HELVIA supports the client in the process of analysing and optimising the company’s economic value, both prior to the possible sale and in the planning phase, by preparing the business plan.

Vendor Due Diligence

Vendor Due Diligence is a service provided by HELVIA in favour of the Principal, in order to facilitate the sale process, to reassure potential Buyers or Investors about the goodness of the target, and to inform the Principal about the limitations and risks involved in future buy-side diligence.

HELVIA Sell-side Transaction Advisory Services (2-2)

Negotiation Assistance

Often the entrepreneur selling a company has no experience in this regard. Since 1984, HELVIA professionals have been assisting them in this crucial phase, preventing fatal and irreparable mistakes. From the selection of potential buyers, to the opening of negotiations; from the examination of LoI/MoU/TS/NBO/BO to the negotiation and finalisation of agreements, HELVIA is at their side with competence, experience, discretion and loyalty.

Sell-side Financial Assessments

HELVIA supports potential Sellers with business valuation services and transfer price negotiation strategies. For more information, please see: ‘Company Valuation Services’.

Virtual Data Room and Due Diligence

Following the signing or acceptance by the potential Seller of a LoI/MoU/NBO/ etc. it is necessary to give access to the books and records of the company or property to the counterparty. HELVIA organises, coordinates the uploading and administers the virtual data room and liaises with the potential Buyer and its trusted advisors to facilitate the dialogue between the parties and the resolution of any operational problems.

Sell-side Corporate and Legal Advice

HELVIA and its attorneys assist the Sellers in setting up the transaction structure, with regard to the extraordinary transaction (transfers, contributions, mergers, etc.), the main and ancillary contracts (shareholders’ agreements, option rights, escrow agreements, leases, employment contracts, etc.), corporate documents (visas, powers of attorney, revocation/reappointment of board members, shareholders’ register, etc.) and financial guarantees (sureties, etc.).

Tax Advice and Estate and Succession Planning

HELVIA guides you in the civil and fiscal choice of the transfer transaction and in positioning and protecting the assets for future generations.

Timing of Sell-side Transaction Advisory Services

How to contact us

For more information and to request HELVIA’s Transaction Advisory Letter of Engagement, please contact the HELVIA Secretariat by email: info@proinvesto.it or info@helviapartners.com or call us on 0041 91 630 97 57.

We will gladly accompany you on the path of acquiring or selling your company and help you to successfully achieve your goals.