Latest searched Companies

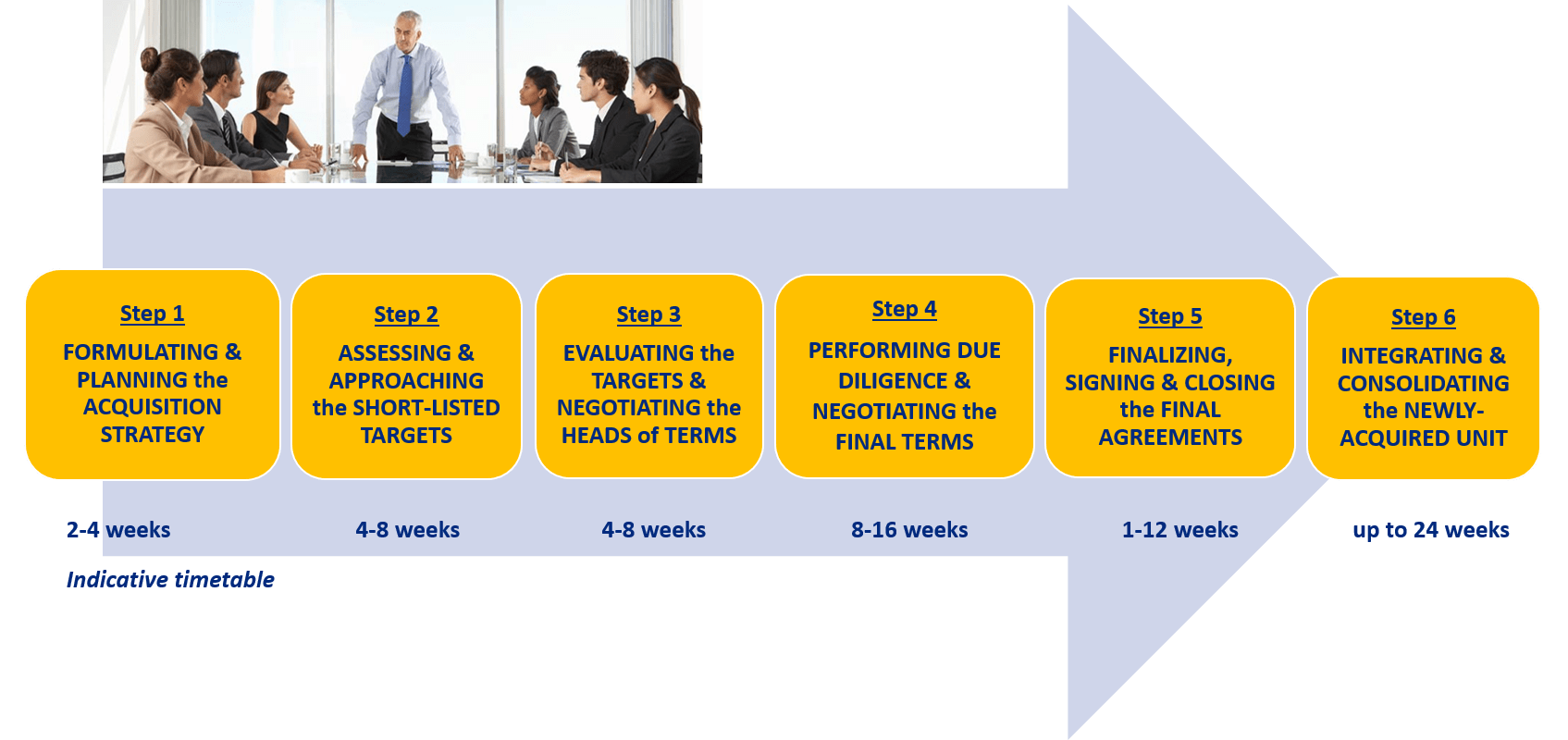

HELVIA’s Buy-side Methodology

BUSINESS ACQUISITION

from STRATEGIC PLANNING to POST-ACQUISITION INTEGRATION

Step 1: STRATEGIC PLANNING OF THE BUSINESS ACQUISITION

1.1 Client’s assignment and project kick-off

1.2 Collection and analysis of business fundamentals, key information and the structure and dynamics of the reference sector

1.3 Explication of the potential benefits and costs of the acquisition transaction by the Client with respect to the possible strategic options

1.4 Identification of the financial resources available to the Client or possibly available through leverage with potential banking or financial partners

1.5 Definition of the Client’s acquisition objectives and criteria

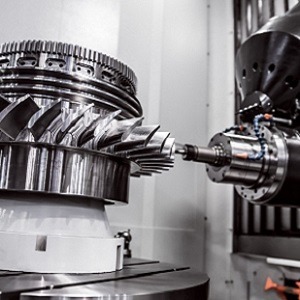

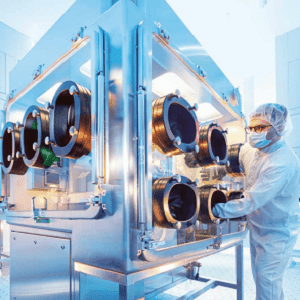

1.6 Description of the profile and ideal characteristics of the target company (target profile) in terms of ownership structure, type of business, market positioning, product offering, industrial capacity and processes, geographical presence, size, economic-financial performance, financial exposure, etc.

1.7 Formulation of the client’s acquisition strategy and possible guidelines for structuring the transaction

1.8 Creation of the Client’s buy-side team, appointment of the team leader, assignment of responsibilities and tasks to team members

1.9 Designing the timetable for the execution of the acquisition project

1.10 Preparation of the client’s corporate profile, agreement on the contents and methods of communication with the client and the negotiating counterparts of the selected target companies

Step 2: SEARCH AND CONFIDENTIAL CONTACT OF SELECTED TARGETS

2.1 Meeting with the Client to collect the possible target companies “liked” (to be solicited) or “disliked” and to agree on the modalities of confidential contact of the actual owners or legal representatives (“Owners”) of the selected targets

2.2 Research of further potential target companies (market intelligence) according to the target profile and geographical area indicated by the Client and identification of the names and confidential contact details of the Owners

2.2 Presentation to the Client of the selected targets of greatest interest (short-list), including the preferred target companies and the “Companies for Sale” selected by the Client on www.proinvesto.it as well as the compliant targets already in HELVIA’s portfolio

2.3 Drafting and transmission of the confidential communication from HELVIA to the Ownership of the selected targets, in the European language deemed most appropriate (Italian, English, French, German and Spanish)

2.4 Confidential contact of the Owners of the selected targets by HELVIA, in which they are asked (on a non-binding basis) if they intend to evaluate the opportunity of selling their company to the potential buyer represented by HELVIA, whose name will remain anonymous until the target is accepted by the Client

2.5 Collection of feedback from the solicited Properties and verification of their actual interest in evaluating the business transfer opportunity proposed by HELVIA

2.6 Gathering of key data and information on the target companies and expectations of the solicited Properties interested in the potential business transfer and transmission of the dossier to the Client for examination and acceptance

2.7 Acceptance or rejection of the Dossier by the Client and return of the outcome to the counterparty. In the event of positive acceptance and subject to signature of a Confidentiality Agreement (NDA), disclosure of the Client’s name to the counterparty

Step 3: MEETINGS BETWEEN THE PARTIES, COMPANY EVALUATION and ACCEPTANCE OF THE LETTER OF INTENT / MOU / NBO

3.1 Organisation of the cognitive and in-depth meetings by HELVIA between the Client and the owners of the selected target companies

3.2 Management of relations, information exchanges and facilitation of interpersonal chemistry between the Client and the Owner (potential Seller)

3.3 Collection and examination of the Information Memorandum and key information of the target company (desk analysis), verification of the objectives and expectations of realisation and transaction by the Owner

3.4 Assistance to the Client in the strategic and financial evaluation of the target company, analysis of the Interest Rate of Return (IRR) of the investment and the possible post-acquisition engagement of the potential Seller

3.5 Assistance to the Client in defining the possible acquisition price of the target company, the contractual structure of the transaction, the implementation modalities and the timing of the possible sale/acquisition agreement

3.6 Negotiation assistance to the Client and facilitation in the conduct of negotiations with the potential Seller in order to reach an agreement on the main functional and economic terms of the transaction

3.7 Assistance in drafting or revising the Letters of Intent (LOI) or Memorandum of Understanding (MOU) or alternatively the Not Binding Offer (NBO) (also in case of auction) and in collecting the acceptance from the potential Seller

3.8 Assistance to the Client in planning and organising the acquisition transaction up to the Closing stage

Step 4: DUE DILIGENCE, DEAL STRUCTURING and NEGOTIATION OF TERMS OF AGREEMENTS

4.1 Organisation and monitoring of the data room, monitoring, performance of certain pre-acquisition due diligence activities (commercial, financial, tax, legal, labour, real estate, IT, environmental, etc.) depending on the availability and territories of reference

4.2 Verification with the Client of the impact of the due diligence findings on the acquisition strategy and on the value of the target company (value bridge)

4.3 Carrying out professional assignments (à la carte) requested by the Client, such as: business plans, financial forecasts, restructuring or financial rebalancing plans, outsourcing plans, transaction structuring, synergies analysis (cost, revenue and capital), post-acquisition integration plans, risk analysis, corporate and tax optimisation plans, tax ruling, etc.

4.4 Finding financial sources to cover the business acquisition, contact and selection of potential debt or equity partners, selection of financial instruments and choice of leverage ratios, negotiation and formalisation of the respective agreements

4.5 Assessment of the financial sustainability of the transaction and credit lines, identification of priority targets, risks and maximum tolerances

4.6 In-depth negotiation and search for final agreement on the terms and conditions of the business sale/acquisition agreement (SPA) and any ancillary contracts (SHA, ORA, leases, consultancy, etc.)

4.7 Preparation of the acquiring company or creation of the acquiring Special Purpose Vehicle (SPV) that will contract the financial debt and conduct the acquisition transaction

Step 5: COORDINATION, SUBSCRIPTION and PERFORMING OF FINAL AGREEMENTS

5. 1 Assistance to the law firm during the drafting/revision of the SPA (Sales & Purchase Agreement), on various issues such as: earn-out and ratchet clauses, representations and warranties, indemnity and loss of profit clauses, payment deferrals and price adjustment/renegotiation clauses, covenants, way-out and clearance clauses, conventional and legal remedies, contractual responsibilities and indemnity obligations of the buyer, seller’s default and cancellation due to fraud, etc.

5. 2 Assistance to the law firm in the drafting/revision of any shareholder’s agreements (Shareholder’s Agreement) or Put & Call Option Rights Agreements, on various topics, such as modalities and timing for the transfer of shares, powers and decisions for the management of the company, co-sale or drag-along clauses (tag-along rights, drag-along rights), material breach clauses, standstill periods, asset drainage, dividend distribution, enforceability of options, price adjustments, collars & caps price limits, non-competition agreements, conciliations and mediations, liquidated damages, dispute resolution, etc.

5.3 Assisting the law firm in the drafting/revision of corporate deeds or other ancillary contracts, such as: new company statutes, revocation and appointment of directors, pledges and escrow deposits, share capital increases, shareholders’ loans, commercial leases of capital properties, employment contracts or vendor consultancy, trademark or patent licences, etc.

5.4 Organising and assisting in the signing (Signing) and finalisation (Closing) of the main sale/acquisition agreement and any subsequent price adjustment/adjustment stages

Step 6: POST-ACQUISITION INTEGRATION OF THE TARGET

6.1 Advice and assistance on the strategic and operational integration of the newly-acquired company with the objectives and strategies of the acquiring company, such as: strategic and organisational alignment plans, operational alignment plans, etc.

6.2 Advice and assistance in the administrative and financial alignment of the newly-acquired company with the directives and procedures of the acquiring company, such as: alignment of the accounting & reporting system, alignment of the human resources management system, etc.

6.2 Advice and assistance on the transfer of resources and competences, in cases where the newly-acquired company does not fully retain its strategic and operational autonomy or in cases where managers of the acquiring company or of external origin are employed in top positions of the newly-acquired company

6.3 Consulting and assistance in planning and monitoring the progress of strategic and organisational plans, restructuring or turnaround, outsourcing, managerialisation or internationalisation

6.4 Consulting, coaching and assistance in the organisational and cultural integration phase of the newly acquired company, such as: organisational climate analysis, management appraisal programmes, change management, team integration, empowerment and development of human capital, incentive plans (MBO) and retention, career and succession plans, etc.

6.5 Recruitment and selection of executives, middle managers and talent, assistance in industrial relations management, union conflict resolution, troubleshooting, etc.

6.6 Reconciliation and mediation of disputes and frictions between the old and new corporate ownership, between the newly acquired company and the acquiring company or its related parties, between the newly acquired company and institutional third parties.

How HELVIA can help you

Business or Property Acquisition Engagements

We search and introduce you to the best target for acquisition and assist you elbow-to-elbow during assessment and negotiation steps, until the deal is successfully executed.

Representation & Management Agreements

Do you have an impediment to searching and acquiring a company or estate in Europe? HELVIA can search, assess and close the deal with the target of your specific interest.