Strategic or Financial Partner Search Engagements

A successful innovative start-up or SME as well as an important real estate or infrastructure project, especially in the phase of high business growth or the execution of large orders or works, may require the contribution of distinctive industrial expertise and/or massive financial resources that only a solid partner can offer. Attempting to procure the necessary resources and expertise on one’s own can be costly, dangerous and sometimes impossible.

Since 1984, the HELVIA Trust Group has been the trusted partner of shareholders, entrepreneurs and legal representatives of companies and real estate or infrastructure structures, to search for potential strategic and/or financial partners, both nationally and internationally (on 5 continents), willing to support collaboratively and synergistically, the process of business growth or the execution of large orders or infrastructure works, both in Italy and abroad. Through its professional and negotiating expertise as well as its national and global network of industrial and financial relations, HELVIA facilitates the construction and consolidation of the agreement as well as the planning and grounding of the strategic alliance pact (equity or non-equity) between the potential partners.

The awarding of the Exclusive Letter of Engagement for strategic and/or financial partner search (search-side) to HELVIA, allows Principals, whether private or public, to concurrently avail of the following professional services

- search, selection and confidential and surgical contact of relevant strategic and/or financial, national and/or global Partners;

- verification of interest by the community of potential Strategic Partners and Financial Investors of HELVIA’s ProInvesto Deal Club;

- access to HELVIA’s exclusive and consolidated partnership methodology and the full range of professional M&A search-side services.

HELVIA’s Resources for Partner Search

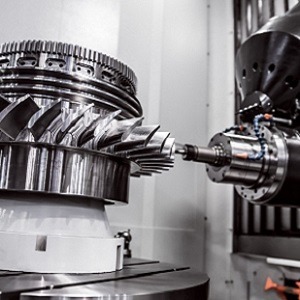

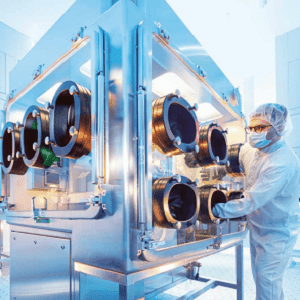

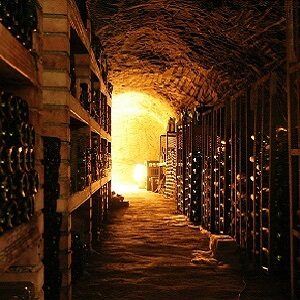

- Portfolio of approx. 500 potential national and global industrial investors (from 5 continents) from the ProInvesto Deal Club, such as: holding companies, multinational groups, small and medium-sized enterprises (SMEs), private investors, etc. – from various economic sectors and real estate segments – for which HELVIA is Advisor/Investment Desk

- Privileged access to thousands of national and global financial and institutional investors such as: private equity/debt, venture capitalists, investment banks, asset management companies, family offices, trusts, sovereign wealth funds, pension funds, foundations, etc.

- ProINVESTO global platform, M&A portals and channels, process automation, big data, analytics, robotics, global targeting tools

- Staff of M&A advisors, business trustees, accountants and real estate experts

- Global and national network of corporate, real estate and financial partners

- HELVIA’s international best practices and M&A methodologies, customisable to the client’s needs

- HELVIA’s global brand reputation

HELVIA’s Partner Search Skills

- Track record of more than 150 extraordinary transactions on corporate groups, SMEs, infrastructure projects and prestigious properties, in Italy, Switzerland and the rest of Europe

- Partnering desk and partner-side advisor on behalf of beneficial owners of over 600 companies and 400 properties located both at home and abroad

- One-stop shop for partner-side M&A services: from identification, search and contact of potential partners to the conception, planning and execution of partnership agreements

- HELVIA’s neuroscientific methodology for building Strategic Alliances

- Facilitation of relations, management of information exchanges and negotiations with counterparts in the main European languages

- Provision of professional assignments such as: corporate restructuring, financial assessments, business planning, due diligence, corporate governance, executive plans, etc.

- M.&A. legal and contractual assistance to the Client’s trusted law firm or our professional partner law firms

Requirements for a Successful Partnership (1-2)

According to HELVIA’s methodology, a successful partnership is based on the progressive achievement of 4 basic understandings:

- the Relational Understanding i.e. the existence of mutual liking (interpersonal chemistry) on the part of the potential Partners and the shared willingness to collaborate in the realisation of a joint venture;

- the Strategic Understanding, i.e. the sharing of vision, general objectives and strategies for realising the business or project. The strategic understanding normally occurs through a (preliminary and synthetic) feasibility study;

Requirements for a Successful Partnership (2-2)

- the Tactical Understanding on the constitutive and operational elements of the business plan or executive project to be implemented. It is based on an analytical view of the market, organisational, economic-financial and implementation plans, taking into account the roadmap, analysis and risk containment measures and the inevitable contingency plan;

- the Operational Understanding on the division of institutional roles, actual and future contributions to be made and corporate governance rules within the future partnership both in the conduct of the deal and in the management of relations between potential partners.

How to contact us

For more information or to request a free HELVIA Partner Search Engagement Letter, please contact the HELVIA Secretariat at the following email addresses: info@proinvesto.it or info@helviapartners.com or contact us by phone on 0041 91 630 97 57. We will gladly accompany you in your search for a strategic or financial partner and help you successfully achieve your goal of growth and profitability.