Financial Advisory Services

The current market conjuncture makes the financial variable increasingly strategic and requires companies to renew their strategies and policies for raising and deploying financial resources.

HELVIA is a leading and independent advisory firm with in-depth knowledge of the markets, services and players in the Financial Community in Italy, Switzerland and the rest of Europe and is able to provide a wide range of strategic and tactical solutions with high added value, both at national and cross-border level, before and after the execution of a business sale, merger or acquisition transaction.

Early recognition and timely resolution of a case of financial distress is the key to success for an effective restructuring that enables the relaunch of the economic value generation process and thus a higher appreciation of the company or property being sold.

HELVIA assists entrepreneurs and administrators of companies in financial distress (especially those burdened by excessive leverage or highly illiquid) by rebalancing their financial structures, reallocating their capital, restructuring their equity and debt instruments, optimising their cash flows and reducing their debt capital burden.

HELVIA’s staff consists of highly qualified professionals with extensive experience in both the professional and industrial sectors. They have a good understanding of the needs of a diverse clientele in terms of sector, size and geographic origin, and address the various professional challenges with a cross-functional approach, and depending on the situation, with a local, national, cross-border or global vision, relationships and tools.

They are able to guide and support you in various financial projects, such as: finding and opening capital to new equity or debt partners selected by the company, planning investment/circulation needs, managing and controlling cash flows, accelerating cash flow and improving treasury, maximising creditworthiness (rating score), renegotiating agreements and optimising relations with banks and financing institutions.

Finally, HELVIA accompanies the directors and managers of successful SMEs to listing on the regulated markets (IPO) of Borsa Italiana (Milan), Euronext (pan-Europe – Amsterdam), SIX Swiss Exchange (Zurich) and LSE London Stock Exchange (London).

Financial Advisory Services (1-2)

- Financial Strategic Advisory

- HELVIA supports company heads in the identification and execution of innovative value creation and portfolio optimisation strategies, through: growth strategies for external lines (M&A and Strategic Alliance, domestic and cross-border); divestment strategies; de-merger/spin-off strategies; strategies for interdiction/defence against hostile actions from takeovers or activist investors, etc.

- Restructuring & Corporate Renewal Advisory

- HELVIA’s professionals help SMEs get out of a state of economic crisis or over-indebtedness by using a multidisciplinary staff of accountants experienced in out-of-court settlements and insolvency proceedings and executive managers with experience in corporate restructuring and rescue, as Chief Restructuring Officer.

- IPO Advisory

- HELVIA assists you in the preparatory and executive phases of the listing of SME securities on European regulated markets. We are always at your side, from the selection of key roles to the management of relations with markets and financial authorities, such as: Borsa Italiana, Consob, Monte Titoli, Euronext, the various European Regulation Authorities, SIX Swiss Exchange, FINMA, LSE London Stock Exchange, FCA, etc.

- Capital Research

- Many SMEs do not effectively access the capital market and this compromises their ability to grow. ProINVESTO and HELVIA connect SMEs seeking venture, intermediate (mezzanine fund) or debt capital (short or medium to long-term – including structured financing) with their extensive network of strategic and financial investors, lenders and financing institutions, nationally and globally.

Financial Advisory Services (2-2)

- Asset and Liability Management (ALM)

- Asset & Liability Management (ALM) deals with the management of capital structure imbalances and related financial risks. HELVIA assists Principals in optimising lending and funding and in mitigating exposures to operational, credit and market risks.

- Financial Flow Planning and Control

- HELVIA analyses, plans and controls the temporal evolution of incoming and outgoing cash and working capital flows in order to neutralise possible financial tensions, reduce the mass of invested working capital, anticipate cash flow and reduce the capital burden.

- Credit Rating Optimisation

- HELVIA’s professionals detect your company’s credit rating and support you in the drafting of plans and reports to present to credit institutions, assisting you in negotiating agreements, rates and conditions.

- Planning and Management of Major Works

- Major works in the Industrial, Civil, Transport, Energy and Environmental fields require large investments. HELVIA supports public and private clients with a wide range of services, including financial analysis, project evaluation and structured financing.

- Project Finance

- We assist in the financial planning phase of the project and assess sustainable leverage. We identify collateral and promote partnerships (PPPs) and consortia with private and institutional investors. Directly or through trusted partners, we set up NewCo and special purpose vehicles (SPV) in Italy, Switzerland and the rest of Europe.

Capital Search Methodology for Innovative Start-up or High Growth Companies

Choosing the right source of finance and the right financial instrument to meet the needs of your innovative start-up or high-growth company is crucial. Since 1984, through its national and global network of industrial and financial partners, HELVIA has helped hundreds of start-up or growth companies search for and select investors and financiers capable of supporting their business plan.

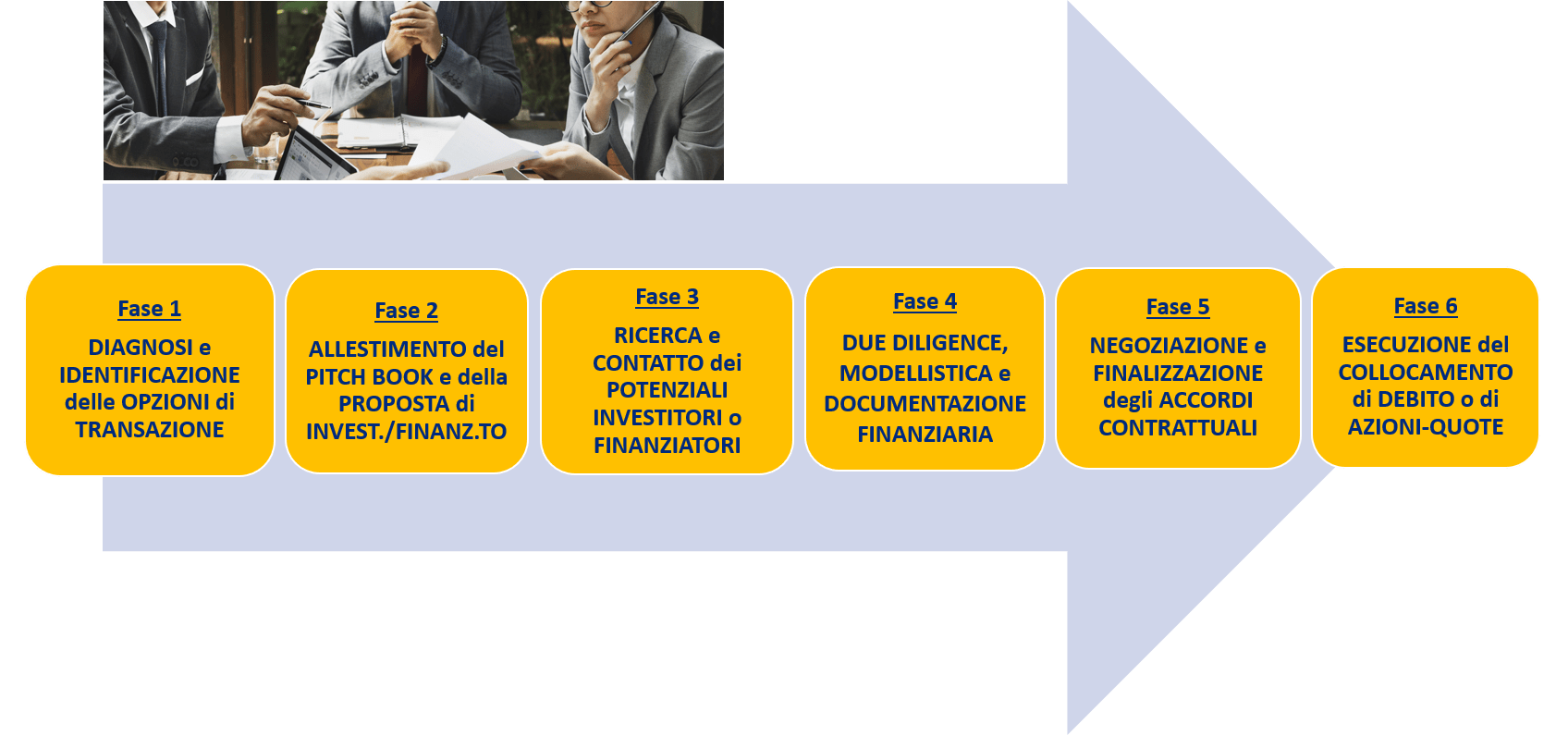

Indicatively, HELVIA’s capital search methodology is divided into 6 main stages:

Types of Risk Capital Financing

- waiver of profit distribution

- contribution of additional risk capital by existing shareholders

- inclusion of new capital shareholders

- withdrawal of capital from pension funds

- guarantees/guarantees on risk capital

- private equity funds

- growth/expansion capital/finance

- venture capital / corporate venture capital

- public private partnership (PPP)

- hybrid instruments (grants, debt and equity capital)

- business angels

- equity/reward crowfunding

- other equity and para-equity instruments of alternative finance

- initial public offerings (IPOs)

- initial coin offerings (ICOs)

Types of Third-Party Financing

- current account receivables / receivables from suppliers / advances from customers

- advances on bank receipts, invoices, contracts, bill discounts

- factoring / documentary credits / export or import financing

- financial and real estate leasing

- loans (mortgage loans, unsecured loans, revolving fund loans, etc.)

- project/real estate financing

- foreign currency loans / pooled loans

- guarantees/guarantees on debt capital

- guarantee funds/confidences/Sace Simest/ Cosme

- bond loans (minibonds, ordinary, convertible, etc.)

- private debt funds / equity financing

- crowlending / real estate crowfunding

- securitisation of receivables and other assets

- regional / cantonal, state, European financial support (EIB, EIF, etc.)

- invoice trading / direct lending / ICOs and token offerings

How to contact us

For more information and to request HELVIA’s Financial Advisory Letter of Assignment, please contact the HELVIA Secretariat by email: info@proinvesto.it or info@helviapartners.com or call us on 0041 91 630 97 57.

We will gladly accompany you on the path of acquiring or selling your company and help you to successfully achieve your goals.