Representative and Administrative Engagements

Representation is effected by the substitution of a trustee (representative) for another person (principal) in the performance of a legal transaction (e.g. purchase or sale of corporate shares, companies, real estate, etc.) in the interest of the principal and within the limits of the powers conferred, the legal effects of which will fall within the sphere of the principal.

Through the administration of assets, the trust company administers, on the basis of instructions received, a portfolio of shares, securities, real estate or other property, which has been transferred to it by the owner (trustor) with the obligation to satisfy certain interests of the same or of a third party, either explicitly or confidentially, by means of a trust.

The reasons for conferring a representation or administration mandate for the management of business affairs or the purchase or sale of corporate participations, companies or real estate may be diverse. From the serious and urgent reasons of the death, disappearance, interdiction or infirmity of the holder to the milder and more legitimate reasons of objective impediment or unwillingness to deal with the matter on the holder’s part or of a request for the utmost confidentiality on the entrusted transaction.

Since 1984, the HELVIA trust group has been the fiduciary partner of shareholders, entrepreneurs, business families and real estate developers to replace the figure of the owner in the running of a company or in the completion of a business deal, in Italy, Switzerland or the rest of Europe.

With professionalism, discretion and the diligence of a good family man, in the exclusive interest of the Principals, HELVIA’s work enables one or more of the following benefits to be secured:

- the continuity of management of the company or real estate, pending its sale or the finding of a successor;

- the search for and contact of potential buyers and the negotiation and finalisation of the sale transaction;

- the completion of a deal to acquire company shares, companies or property, either explicitly or confidentially;

- the protection, administration and performance of an asset or right or property, in an explicit or confidential manner.

HELVIA’s Management or Negotiation Engagement

With the Contract of direct representation, the trust company HELVIA acts in the name and on behalf of the principal, within the limits of the powers conferred upon it. The effects of the transactions concluded by it fall directly within the legal sphere of the principal, as if it had concluded them in person.

By entering into the agency mandate, the trust company HELVIA undertakes to perform one or more transactions in favour of the principal, such as

- the management of continuity, optimisation of performance and preservation of assets, in the case of the receipt of a ‘management representation mandate‘ for the conduct of the affairs of a company or the administration of real estate;

- the search and selection of potential buyers, opening of negotiations, negotiation and finalisation of agreements, in the case of receipt of a ‘mandate of negotiating representation‘ to sell or acquire certain company shares, a company or real estate, respectively, owned by or in the interest of the represented party.

HELVIA’s power of attorney is accompanied by a power of attorney, which may be general (ad negotia) if it is granted for the performance of a number of legal transactions, such as, for example, the management of a company or real estate as an agent, or special if it is granted for the performance of certain acts as an agent, such as, for example, the sale or transfer of a company shareholding, company or property. The power of attorney to be granted to HELVIA must be formal and concluded in the same form as that required for the transaction to be concluded.

Unlike the power of attorney, which authorises the representative to perform acts, the mandate obliges him to perform such acts. Power of attorney and mandate thus have two different functions.

HELVIA’s Engagement of Assets Administration

With the Asset Administration Mandate (with or without fiduciary header), the trust company HELVIA assumes the task of administering on behalf of the Principal, one or more movable or immovable assets or rights, such as, for example: company shareholdings, real estate, financial assets, works of art, inheritances, held in Italy, Switzerland or the rest of Europe. HELVIA guards them, takes care of the exercise of their rights in order to produce an income and returns them on expiry or revocation of the mandate.

HELVIA acts professionally, transparently and confidentially in the sole interest of the trustor or third parties designated by him. The trustor’s administered assets are kept separate from HELVIA’s assets and cannot therefore be attacked by any creditors of HELVIA.

In the mandate of administration “without fiduciary header“, HELVIA administers the assets from a civil and fiscal point of view, without appearing as the owner of the same and therefore without any protective screen of the identity of the trustor and confidentiality towards third parties.

In the administration mandate “with fiduciary header”, HELVIA administers on behalf of the trustor, but in its own name, the transferred assets and as such appears and acts towards third parties, guaranteeing the confidentiality of the trustor. There is therefore a clear separation between the formal ownership of the right, which remains with the trustor, and the legitimation to exercise that right, which is transferred to HELVIA.

As a ‘static’ trustee, HELVIA does not have the ‘power to manage’ the assets received at its discretion. It can only administer them (including selling them or converting them into other types of assets) according to the instructions given by the trustor, who retains the right to change or revoke them at any time. The risks of transactions concluded on the instructions of the trustor obviously remain with the trustor.

HELVIA’s Methodology for Representative and Asset Administration Engagement

The execution of a mandate to represent or administer assets requires professional, managerial and negotiating skills, and compliance with financial and tax regulations as well as anti-money laundering and anti-terrorist financing. HELVIA’s methodology is based on adequate verification of the clientele, the title and origin of the entrusted assets, and the lawfulness and feasibility of the legal transactions requested.

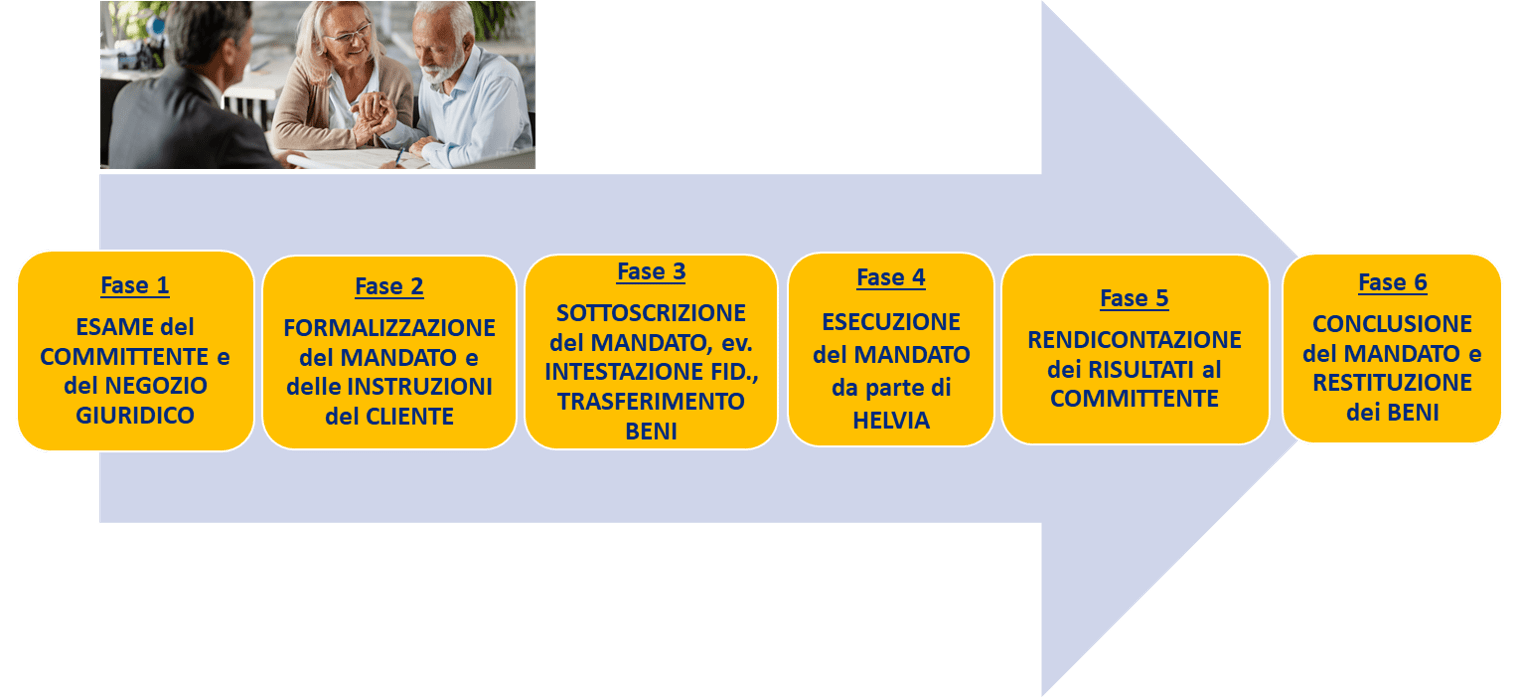

Indicatively, the methodology of HELVIA’s Representation or Administration engagement is divided into 6 main stages:

Cases of use of the Representative Engagement

- sale or management of shareholdings, controlling stakes, business units, real estate or particularly valuable assets (e.g. works of art) in the event of the sudden death, disappearance, permanent or temporary disability of the beneficial owner

- sale or purchase or management of share packages, controlling stakes, business units, real estate or particularly valuable assets in the event of objective or subjective impossibility (due to physical distance, excessive work commitments, etc.) on the part of the potential seller or buyer

- sale or purchase of packages of shares, controlling stakes, company complexes, real estate or particularly valuable assets in the presence of persons of high notoriety (celebrities) or where the utmost confidentiality is required as to the existence of the possible transaction by the potential seller or

- buyerpreparation and execution of precautionary warrants pursuant to Article 360 of the Civil Code. Swiss Civil Code to take care of the personal care, property interests and legal representation of the appointing party in cases where he becomes incapable of discernment;

- in all cases in which the negotiating or managing representation work of the HELVIA trust company is deemed to be an indispensable added value for the Principal.

Cases of use of the Administration Engagement

- administration (with or without fiduciary registration) of packages of shares, controlling stakes, business units, real estate or particularly valuable assets (e.g. works of art) or rights of significant value (e.g. inheritance) on the occasion of the sudden death, disappearance, interdiction, infirmity or objective or subjective impossibility on the part of the beneficial owner

- sale or conversion into other types of assets (with or without fiduciary registration) of packages of shares, controlling stakes, business units, real estate or particularly valuable assets (e.g. works of art) on the occasion of the sudden death, disappearance, interdiction, infirmity or objective or subjective impossibility on the part of the beneficial owner

- coordinated control of shareholdings in various companies and efficient management of complex movable assets, especially with a view to carrying out a generational handover, protecting family assets and ensuring business continuity

- assuming the joint representation of bondholders or shareholders or the role of third party custodian (escrow agent) of packages of securities or cash in the context of sale and purchase transactions or in the case of usufruct rights;

- in all cases in which the work of the HELVIA trustee is deemed to be an indispensable added value for the Principal.

How to contact us

For more information or to request a free HELVIA Exclusive Buy-side Assignment Letter, please contact the HELVIA Secretariat by email: info@proinvesto.it or info@helviapartners.com or call us on 0041 91 630 97 57.

We will gladly accompany you on the path to acquiring your company or property and help you to successfully realise your goal.