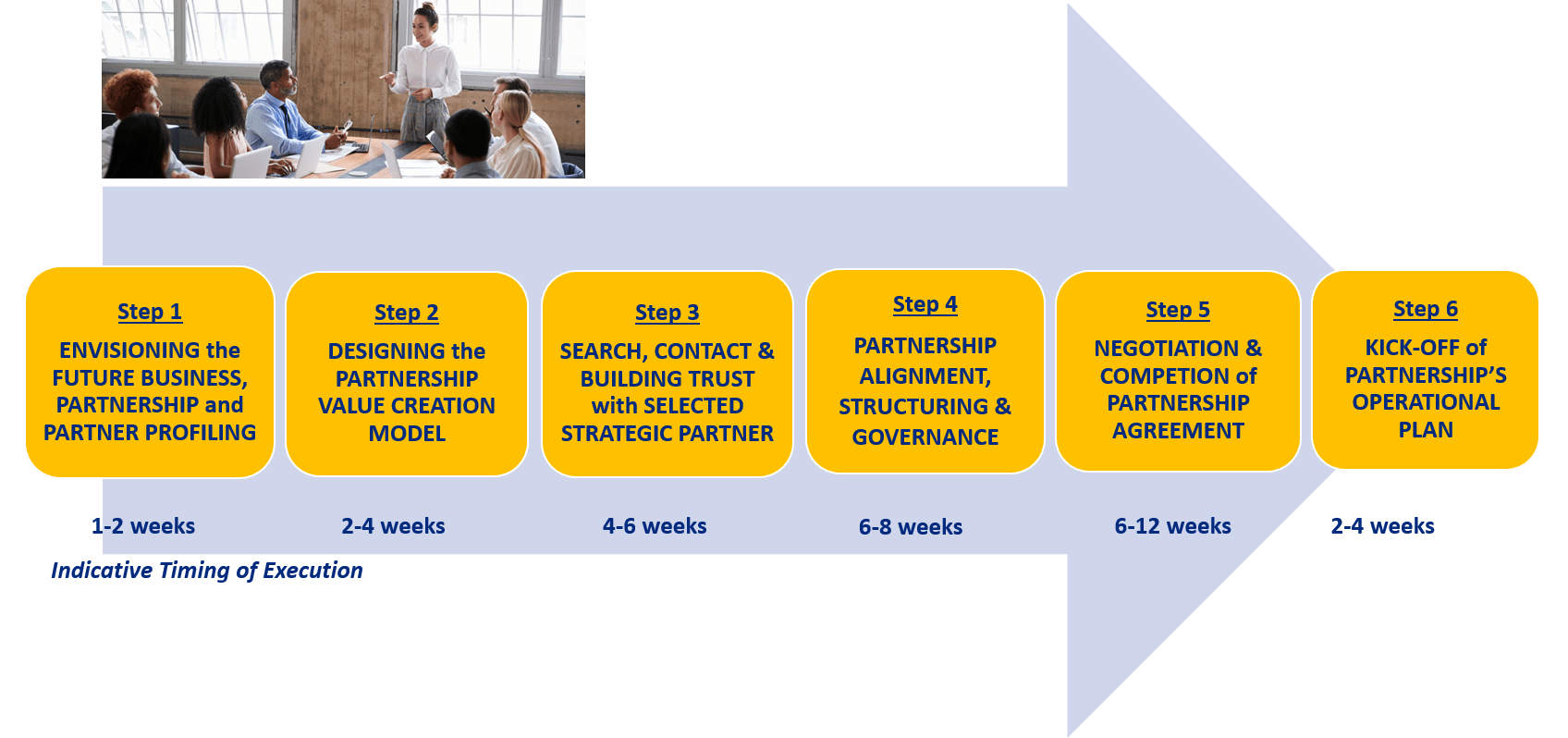

Strategic Partners’ search process

SEARCHING STRATEGIC PARTNERS

from ENVISIONING the FUTURE to KICKING-OFF the OPERATIONAL PLAN

Step 1: COMPANY DIAGNOSIS and PREPARATION for SALE

1.1. Exclusive commissioning and kick-off meeting with the Customer

1.2. Collection of information on industry, fundamentals and business model, competitive strategy, critical success factors, product offering, customers and channels, sales organisation, order book, growth potential, etc.

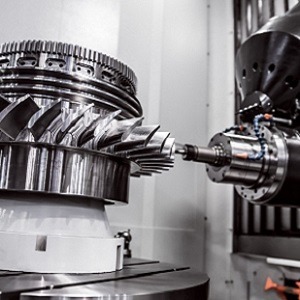

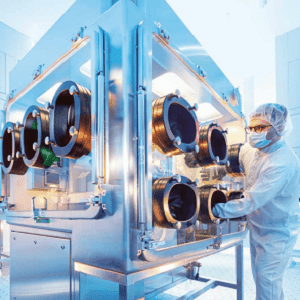

1.3. Collection of information on technology, know-how, works of art, operating system processes and work cycles, means of production, quality, certifications, logistic chain, instrumental properties, investment plan, etc.

1.4. Collection of information on organisational structure, skills balance, operational processes and mechanisms, management and key players, labour costs, etc.

1.5. Collection of information on financial statements, consolidated financial statements, reporting, notes, financial structure, leasing, accounting principles, inventories, depreciation, managerial salaries, non inherent costs, normalisations, etc.

1.6. Collection of information on legal, tax, corporate, labour, trade union, litigation, safety, health, environment, etc.

1.7. Checking for strategic coherence and competitiveness, organisational self-sufficiency, economic-financial sustainability, any areas of high sensitivity, material limits and acceptable risks

1.8. Identification of objectives, criteria, sales methods on the part of the selling customer and its willingness to be accompanied

1.9. Collection of historical reporting, business plan and planned financial requirements for the next 4-5 years

1.10. Handing over of HELVIA’s Management Letter to the Principal, presenting the transfer strategy and operational recommendations for the best possible preparation of the company for sale

Step 2: COMPANY EVALUATION and SET UP OF THE PITCH BOOK

2.1. Preparation of the company’s financial evaluation on the basis of the methods recommended by professional doctrine and practice and recognised by the market

2.2. Preparation and presentation of the Investment Teaser (anonymised)

2.3.Publication of the Confidential Sale Announcement on HELVIA’s proprietary platform www.proinvesto.it and related social channels

2.4. Confidential transmission of the Investment Teaser to ProInvesto’s Investors Club (over 400 industrial investors)

2.5. Preparation and presentation of the Information Memorandum

Step 3: SEARCH, SELECTION and CONFIDENTIAL CONTACT of POTENTIAL BUYERS

3.1. Research and selection of potential domestic and foreign Buyers (target list)

3.2. Exclusion of undesirable targets or no-touch targets

3.3. Identification of the decision makers of the selected targets

3.4. Round I and II of the campaign to circulate the investment teaser to the decision makers of the selected targets

3.5. Collection of feedback from the selected decision makers

3.6. Setting up, transmission and collection of the signature of the Confidentiality Agreement (NDA) from the target decision makers

3.7. Transmission of Infomation Memorandum to interested decision makers

3.8. Follow-up meetings and conference calls with interested decision makers

3.9. Possible transmission of additional information requested

3.10. Collection of the final decision by the decision makers concerned

Step 4: PRESENTATION OF POTENTIAL BUYERS and LAUNCHING OF TRANSACTIONS

4.1. Organisation of cognitive meetings between the Customer and potential Buyers

4.2. Verification of objectives, investment criteria and implementation methods by the potential Purchaser

4.3. Verification of the reputation, financial soundness and possible contribution to the company’s growth by potential Buyers

4.4. Negotiation assistance in preliminary negotiations with potential Acquirers

4.5. Presentation of the financial valuation and justification of the sale price requested from the potential Purchasers, in light of the “objective value” of the company and the potential synergies achievable by the potential Purchasers

4.6. Negotiation assistance on the vision of business development by the potential Purchasers, on the contractual structure of the transaction, on the implementation methods and timing of the possible sale agreement

4.7. Collection of feedback and indicative offers submitted by the potential Purchasers

4.8. Drafting of LOI/MOU/TS non-binding agreements (letter of intent, memorandum of understanding, term sheet) and any revisions to the initial agreements or drafting of moratorium agreements

4.9. Negotiation assistance on the individual points of the non-binding LOI/MOU/TS agreements under discussion with the potential Buyer, including possible price or pricing system, possible contractual terms, secrecy constraints (strictly classified information), possible BCL requests, applicability of possible penalties in case of counterparty abuse, etc.

4.10. Final drafting of LOI/MOU/TS non-binding agreements and collection of signatures by the Customer and the potential Buyer

Step 5: DUE DILIGENCE and FINALISATION OF TRANSACTIONS

5.1. Coordinate the structuring of the company’s information room

5.2. Assistance in the due diligence phase inherent to the collection of questions, provision of information, resolution of critical issues with regard to potential Buyers and its trusted advisors

5.3. Discussion of the final outcome of the due diligence with the prospective Purchasers

5.4. Execution of professional assignments (à la carte) requested by the Purchaser,

such as: business plans, financial forecasts, synergy analysis, outsourcing of administrative, organisational and management activities, tax optimisation, etc.

5.5. Settlement of any outstanding legal, tax or administrative issues

5.6. Guidance and negotiating assistance in the finalisation of the agreement, evaluation of options, exchange of concessions, management of stalls, option rights, pre-emptions, drag rights, earn-outs, representations and warranties, indemnities, etc.

5.7. Mock-up presentation of the contractual framework to the appointed law firm

5.8. Assistance in reviewing the draft of the contractual structure prepared by the lawyer

5.9. Assistance in negotiating the markups proposed by the potential purchaser

5.10. Assistance in the revision of the assignment agreement and any ancillary contracts

Step 6: SUBSCRIPTION and PERFORMING OF THE ASSIGNMENT AGREEMENT

6.1. Organisation of the Signing of the Transfer Agreement

6.2. Organisation and monitoring of the activities of the Principal in the intermediate period between Signing and Closing (deadlock period)

6.3. Coordination of the activities of the final balance of any price adjustment

6.4. Review of ancillary completion contracts (escrow agreements, etc.)

6.5 Organisation of the meeting to finalise the assignment agreement (Closing)

How HELVIA can help you

Search for Strategic Partners

Search for your Strategic Partner with HELVIA Trust. Through our national and global network of SMEs, corporations and investors we will help you find a partner and finalise your transaction.

Search for Financial Partners

Do you need development capital for your company, property or project? HELVIA Trusteeship helps you find a Partner and negotiate and finalise the investment or financing agreement.