Business or Property Buy-side Assignments

The acquisition of a company or property arises from the willingness of the potential purchaser (‘bidder‘) to pursue a policy of growth by external lines and from the identification of an opportunity, current or prospective. This opportunity may arise from strategic postures such as: horizontal concentrations, vertical integrations, concentric or conglomerate diversifications, internationalisation, restructuring, etc., or simply from contingent opportunities.

Since 1984, the HELVIA Trust Group has been the trusted advisor of directors, entrepreneurs and managers to research, select and acquire companies (corporate groups or SMEs) or valuable properties (“targets”) in Italy, Switzerland, the rest of Europe and EMEA of any sector and size.

With confidentiality, professionalism and effectiveness, HELVIA favours the search, selection, acquisition and integration of the targets in the potential Buyer’s business portfolio, ensuring their strategic growth as well as the best contractual and financial investment conditions.

The granting of the Letter of Engagements for the acquisition of the Company or Property to HELVIA (buy-side), allows the Buyers to avail themselves of the following fiduciary and professional services:

- research and confidential contact by HELVIA of the domestic and foreign Owners of the selected targets to verify their interest in a potential sale;

- access to the extensive portfolio of opportunities of company targets or properties for sale of HELVIA and its international partners;

- negotiation assistance to the client or the execution by HELVIA of the acquisition transaction, from strategy formulation to post-acquisition integration;

- access to HELVIA’s consolidated expertise and extensive range of sell-side M&A services à la carte, depending on the scope of the assignment.

HELVIA, for the exclusive benefit of its Principals, can act as:

- “Buy-side Advisor” assisting owners, directors and managers of multinational groups, SMEs, family offices and industrial, financial and real estate funds as well as private investors, in the search for and execution of acquisitions and investments in national or European targets;

- ‘Investment Desk‘ by fully managing the acquisition or pipeline of national or European target acquisitions on behalf of Clients.

HELVIA’s Resources to purchase a Business or Property

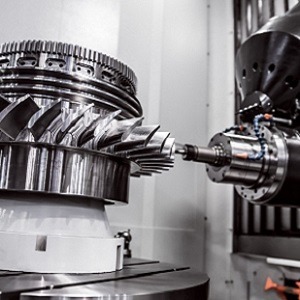

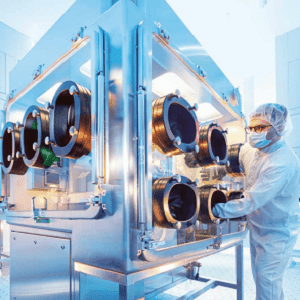

- Selected portfolio of approx. 600 companies for sale (SMEs in the following sectors: High-Tech, Industry, Commerce, Services, Energy, Construction, Agribusiness, Fashion, Healthcare, etc.) located in Italy, Switzerland, the rest of Europe and EMEA

- Selected portfolio of approx. 400 real estate properties (tourist-receptive, industrial, commercial, executive, sky-land palaces, historical villas, clinics-RSAs, etc.) and infrastructures (energy-telecommunication networks, waste collection-recycling centres, airports-airports, etc.) located in Italy, Switzerland and the rest of Europe

- Privileged access to thousands of owners and administrators of domestic and foreign companies, real estate and infrastructures

- PRoINVESTO platform, domestic and foreign M&A portals and channels, process automation, big data, analytics, global targeting tools

- Staff of M&A advisors, business trustees, accountants, real estate experts

- National and global network of industrial, financial and professional partners

- HELVIA’s international best practices and M&A methodologies, customisable to the client

- HELVIA’s brand reputation and global expertise

HELVIA’s Competences to purchase a Business or Property

- Track record of several hundred extraordinary transactions carried out on corporate groups, SMEs, valuable properties and strategic infrastructures, in Italy, Switzerland, the rest of Europe and the EMEA region;

- Buy-side advisory and investment desk on behalf of approx. 500 industrial, financial, real estate and private clients – national and global (from 5 continents);

- One-stop shop for M&A buy-side services: from the search and contact of potential targets to the assistance or conduct of negotiations; from the signing and finalisation of agreements to the integration of the target into the acquiring group;

- Relationship facilitation, information exchange management, negotiations and dispute resolution, in the main European languages

- Transaction and Corporate Advisory à la carte assignments: financial assessments, business plans or turnarounds, post-acquisition integrations, economic analyses, due diligence, deal structuring, search for strategic partners or complementary capital, executive search

- Legal assistance and collaboration with the client’s law firm

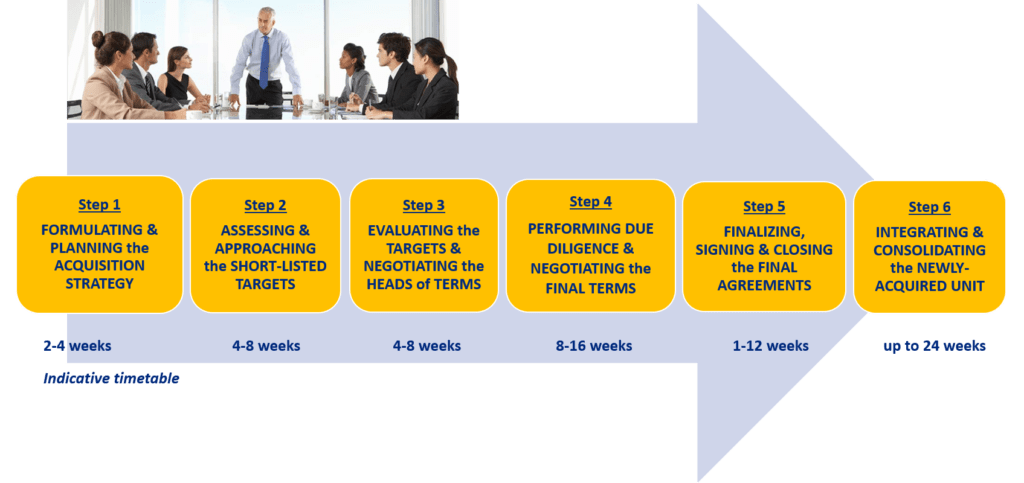

HELVIA’s Business Acquisition Methodology

The success of an acquisition depends on the strategic, financial and cultural fit of the target with respect to the growth plan, the skill of the negotiators, and the ability to generate economic value. HELVIA puts its expertise and proven acquisition methodology at the service of the client in order to acquire valuable results, avoiding waste of time and resources, poor or vacuous outcomes, prejudicial errors and court cases.

The methodology is divided into 6 main phases and respective sub-phases. For more information, please download the ‘Acquiring a Company‘ brochure

HELVIA’s Added Value for the Buyer (1-2)

- we support you in identifying realistically achievable targets and the best business or property acquisition strategy

- we plan and organise the Target acquisition project with the expert support of HELVIA’s professionals

- we search for and select the best Targets available on the market, at national and European level, in line with your acquisition strategy

- we contact, on behalf of the HELVIA Trust, the actual Owners of the Targets and propose the acquisition on behalf of our (anonymous) Principal

- we verify their interest, resolve their doubts and facilitate the relationship (also in a foreign language) with the Principal

- we verify the strategic, economic and cultural fit of the Target and the existing synergy potential in order to maximise the economic value to be derived from the integration of the Target into the acquiring company

- we optimise the terms of negotiation transparency, contractual protection and economic viability of acquisition and ancillary contracts

- we minimise operational and financial risks and correlate the cost of the investment in relation to the results achievable by Target

HELVIA’s Added Value for the Buyer (2-2)

- we solicit interest in the sale from Target owners, bringing the credibility and expertise of HELVIA’s professionals into play

- we organise meetings and working agendas between the parties and assist or replace the Principal in negotiations with the owners

- we coordinate information exchanges between the counterparties (also in foreign languages) and facilitate comprehensive and transparent communication

- we assist the client in evaluation, business planning, bid preparation, due diligence, deal structuring, etc.

- we support and provide useful recommendations to the client on how to proceed during the negotiation process

- provide the client with a pricing strategy for the acquisition of the Target, including the opening price (entry price) and the reservation price (ultimate price)

- we help resolve stalemates or exacerbated negotiating and contractual conflicts between the counterparties

- we ensure the fairness of the deal and the win-win balance between the parties, in order to create a relationship of mutual trust and collaboration

How to contact us

For more information or to apply for the HELVIA Trustee’s Exclusive Letter of Acquiring (Buy-side), please contact the HELVIA Secretariat at the following email addresses: info@proinvesto.it or info@helviapartners.com or call us on 0041 91 630 97 57. We will gladly accompany you on the path to acquiring your company or property and help you to successfully realise your investment and growth goal.